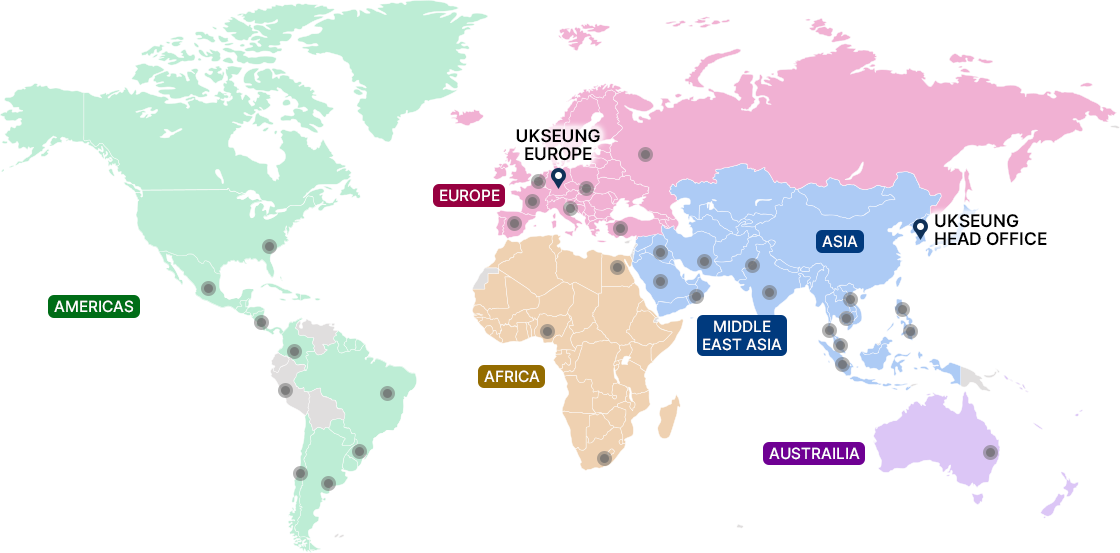

Ukseung Chemical’s market position

Korea’s No. 1 pigment manufacturer

World’s 3rd largest fluorescent pigment manufacturer

Local production of pigments for security printing

Diversification of business including IT materials and special adhesives

World’s 3rd largest fluorescent pigment manufacturer

Local production of pigments for security printing

Diversification of business including IT materials and special adhesives